We refer to a municipal bond as a "muni." Simply put, this is a type of debt that local

governments or municipalities issue to fund public initiatives, such as schools highways, and hospitals. In the context of investors, municipal bonds have

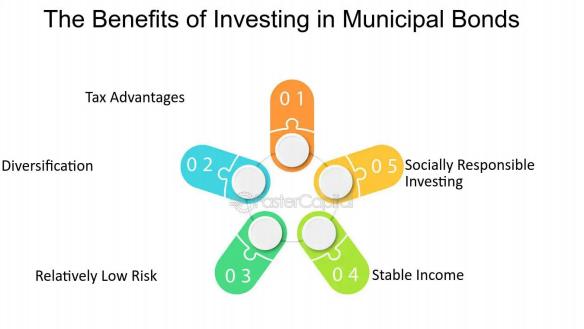

advantages that range from tax advantages to stable returns.

They are very attractive because they offer a low-risk investment with an income flow that comes out in a predictable manner. So here's a look behind why, indeed,

municipal bonds can make sense for investment portfolios.

Key Takeaways

• Many municipal bonds are tax-free income.

• Low risk, since these are guaranteed by the local or state government.

• Earning income while contributing to public projects and helping communities

What Is a Municipal Bond?

Municipal bonds are actually a type of loan that investors make for state or local

governments. In this case, the government gives investors interest through time and covers them when the bond matures at the end of the term.

General Obligation Bonds (GOs): This type of bond is secured through the taxing ability of the issuing government, very secure and hence regarded as low-risk.

Revenue Bonds: The repayment is made out of revenue generated from the projects financed by the bond, such as highway tolls, public utilities, etc. Such securities carry a slighter more risk but could offer competitive returns.

Low Risk and Stability

Municipal bonds are outright risk-free investments. Normally, governments have

streams of income in the form of taxes or utility charges that they can always fall

back to when repaying their debt just to hide bondholders. For this reason, municipal bonds often appeal to conservative investors looking for a stabilizing element in their portfolios.

Why Municipal Bonds Are Low Risk

Government Support: Most of the municipal bonds receive support from the taxing authority of the municipality issuing the bond. From this point of view, they carry a low probability of default.

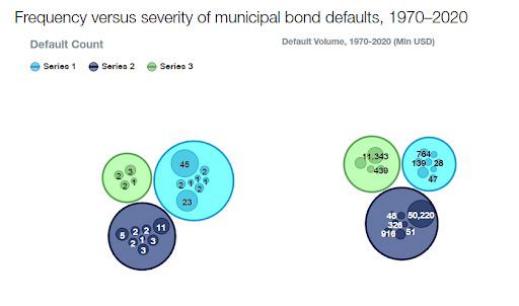

Historical default rates: Defaults in muni bonds occur very rarely, and even lesser when it comes to good-grade bonds.

Creditworthiness: Good-grade municipal bonds carry excellent credit ratings that

limit the chances of defaults.

Steady Income Stream

Municipal bonds could give an ordinary flow of income since their interest is paid

regularly according to schedule-a term that is usually two times a year. This might be very attractive for the retirees or anybody else looking forward to such a regular and predictable flow of income.

Characteristics of Income Flow:

Fixed rate of interest Payments: A fixed rate is paid to the investor at regular intervals that may help in long term financial planning.

Semiannual pay: Municipal bonds normally pay their interest every six months; thus, they are great for income-oriented investors.

Less volatility: The municipal bonds do not experience fluctuations in the prices of investment as occurs in the stock market. This provides a stable source of income during times of uncertain markets

Portfolio Diversification

These bonds also happen to be less volatile for the portfolio and have a tendency to perform well in uncertain times whether it is the economy or stock market volatility. Equities, by their very nature do have a high peak-to-valley cycle thus a municipality is useful for any well-diversified portfolio.

Diversification Benefits

Low correlation with equities: Bonds are not a matter of equity-variability, so they can be used to balance the risk of a portfolio when equities are getting too volatile.

Lower total risk: Diversification into bonds can even minimize the risk being taken in your portfolio by evening out downside and upside risks that tend to exist in other

asset classes.

Shelter in downturn: In the bearish season, these municipal bonds can serve as refuge for the investors.

Funding of community projects

Investment in municipal bonds will not only keep finances sound but also contribute to something even bigger since it aids funding public projects, and these projects are the lifeline of society. They could be on school construction, hospital construction, or road construction-your money is sure to make a difference in enhancing the

infrastructure and services of local communities.

Community Impact:

Public service funding: Your money is channeled into funding and funding key projects such as health facilities, educational centers, and transport systems.

Social responsibility: To socially responsible investors, this investment provides a means through which they can also support the public good as returns trickle in.

Economic growth: The kinds of municipal bonds, for funding public projects, contribute to the strengthening of the local economies and thus contribute to stimulating the economy besides offering employment.

Conclusion

Municipal bonds are a safe and tax-conscious way of amassing relatively stable

returns while funding public works. It is an excellent opportunity for those who would like to diversify their portfolios and protect their wealth, irrespective of how long ago or near you are to retirement or the level of conservatism in investment.

Innovative Crowdfunding: Transforming Dreams into Reality Without Breaking the Bank

Robo-Advisors vs. Human Advisors

How Can Smart Equipment Financing Drive Business Growth?

How Can You Master Tax Strategies for Financial Success

The 8 Best Budgeting Apps for 2024

Women and Wealth: Financial Gap and Building a Future

Best Retirement Funds for Long-Term Growth